THE SUPPLY CHAIN BLOG

Why you Should Prioritize Reverse Logistics and Returns Management

This year, returns set an all new single-day high and certain companies are so overwhelmed that they are refunding consumers and telling them to keep the items rather than shipping them back. Returns have become a large pain point for many companies and can add a lot of extra costs when not handled correctly. A thorough understanding for reverse logistics and returns management can allow companies to minimize the added costs and recoup some value while earning increases in customer loyalty.

This year, returns set an all new single-day high and certain companies are so overwhelmed that they are refunding consumers and telling them to keep the items rather than shipping them back. Returns have become a large pain point for many companies and can add a lot of extra costs when not handled correctly. A thorough understanding for reverse logistics and returns management can allow companies to minimize the added costs and recoup some value while earning increases in customer loyalty.

Returns can happen in any industry for many different reasons. Whether the reason for return is the consumer’s fault (e.g. they ordered the wrong size), a carrier’s fault (e.g. product got damaged during transit) or the distributor’s fault (e.g. shipped an expired product) every company should prepare themselves to handle reverse logistics and returns.

The What: Standardized Process with Automated Workflows

All efficient returns management strategies rely on understanding returns data so that standardized processes can be built, and workflows can be automated. This will prepare an operation to handle all the different returns and minimize the decision making happening in real-time. Defining necessary functionality and selecting appropriate support systems is good practice. A pre-screen with the consumer to allocate the return into the correct workflow allows the logistics team to predict and plan for inbound goods. Workflows can vary company to company, but a quality check is consistent. Assessing goods and distribution into pre-determined workflows leads to quick turnaround time and fastest recouping of investment.

The Why: Financial Incentive AND Customer Loyalty

Financial incentive is clear – the opportunity to resell the goods and recoup value, whether on the primary market in full or a secondary market for fractions. What is less recognized, is the influence on customer management. Customer expectations are high for returns – quick and easy response with free shipping. Managing that relationship can go a long way. Remember that returns contribute to the bigger picture: customer loyalty and repeat sales.

The How: Valuation

With every product, being able to appraise a return is absolutely necessary. Understanding why the return is being made, any repair/refurbishment costs necessary and the future-value of the product reselling (if at all) on the primary or secondary market is key. Having a system in place to do so is extremely important. It has even led to some companies leaving the product with consumer free of charge.

Goods valuation does not paint the entire picture. A considerable piece of the puzzle is customer loyalty and retention. Determining value here is specific to each company, and something not to be ignored.

Looking Ahead

A trend significant of late is that of sustainability. Government regulations have taken interest in the proper disposal of goods and incentivized reuse and recycling. Secondary markets have flourished in recent years, leading to the development of closed-loop supply chains – those with 0 waste. We predict that 2021 continues to bring a focus to ESG initiatives, and that those not invested there will be left behind.

5 Supply Chain Trends for 2021

This past year has created many new challenges for everyone, causing consumers and companies to adapt. We expect some of the supply chain changes to be temporary but that many of them will have a lasting impact on the supply chain industry going forward. Below, we discuss some of the trends that we expect to see in 2021.

This past year has created many new challenges for everyone, causing consumers and companies to adapt. We expect some of the supply chain changes to be temporary but that many of them will have a lasting impact on the supply chain industry going forward. Below, we discuss some of the trends that we expect to see in 2021.

Fulfillment and Logistics as a Competitive Tool

Every year we continue to see consumer behavior change, and in no year has that change happened as rapidly as in 2020. People want to get quality goods for a reasonable price and quickly. Unorganized supply chains will become increasingly exposed as companies will have to choose between bad service levels or unsustainable costs to meet customer demand. The most obvious example of this trend is Amazon's move to achieve next-day or same-day shipping. As stated above, consumer expectations for service continue to rise. This means businesses that have systems in place to forecast well, stock optimal levels of inventory and fulfill efficiently have a significant advantage over those that do not.

Focusing on E-Commerce, Service Levels and Omnichannel Development

The shift from brick and mortar retail to e-commerce has been growing every year, and COVID-19 only expedited that growth even more. It's no surprise that consumer’s extreme shift to e-commerce seen in 2020 will have a lasting effect on the way people do business moving forward. In addition to the e-commerce shift, service levels are also becoming a higher focus as consumers are going to choose the quickest and most reliable option. To keep up with these shifts, companies are going to have to continue to focus on developing their omnichannel strategy. This means using support systems to create an interconnected network of stores, warehouses and 3PLs, providing the flexibility to fulfill both large wholesale purchases and small e-commerce orders. Companies can then leverage this interconnectivity within the network to optimize fulfillment strategy on an order level basis.

Shifting E-Commerce to a 3PL

Another industry trend we expect to see is a significant shift for e-commerce distribution towards third-party logistics companies (3PLs). The e-commerce industry, in comparison to brick and mortar stores, presents a complexity that is hard to tackle for smaller companies. 3PLs provide an option that will allow companies to set up much quicker than if they opened their own warehouse and allow them to avoid significant fixed costs, have access to an already established network and get specialized processes based on their needs.

Making Procurement a Focus

COVID-19 complications and global trade friction with China mixed with consumer’s increasing expectations for better service have signaled to the supply chain world that now may be the time to focus on procurement. By moving suppliers closer to home (near-shoring) and prioritizing the procurement process to make lead time and flexibility priorities, companies can improve their fulfillment times and overall supply chain. Developing a regional supply chain offers the better potential for mutually beneficial relationships and improves both time and proximity to market. This confidence in relationship management and product could challenge the prior approach of low-cost country sourcing.

Freight Normalization – A New Baselinne

COVID-19 has caused overwhelming increases to volume causing capacities to be tested and costs and rejection rates to skyrocket. As the freight companies profit on these higher rates, it can be expected that they will reinvest into capital expenditures, such as more trucks, increasing capacity to meet market demand and normalizing from the economic shifts of 2020.

We wish everyone a safe and healthy 2021.

Blockchain in Logistics: How it Started and How It's Going

Blockchain’s origin is rooted in the release of the whitepaper written under the name Satoshi Nakamoto explaining the foundation of what we know as today, Bitcoin. Bitcoin offered an avenue to worry-free digital transactions due to transparency and decentralization of the data. This ensured that information could not be altered and prompted the crypto-currency boom. The core-principles of blockchain and success of Bitcoin started a wave of curiosity into other possible applications, thus the development of the technology began to arise. One of these applications was supply chain.

Blockchain’s origin is rooted in the release of the whitepaper written under the name Satoshi Nakamoto explaining the foundation of what we know as today, Bitcoin. Bitcoin offered an avenue to worry-free digital transactions due to transparency and decentralization of the data. This ensured that information could not be altered and prompted the crypto-currency boom. The core-principles of blockchain and success of Bitcoin started a wave of curiosity into other possible applications, thus the development of the technology began to arise.

One of these applications was supply chain. Blockchain emerged and appeared to be the solution to everyone’s problems. In 2019, The Port of Rotterdam and The Port of Busan pilot tested blockchain into their maritime logistics and found success in automation and reducing operation cost.

What is Blockchain? As Explained from Blocklab:

A “digital ledger” or spreadsheet that is duplicated and stored in a distributed network in multiple locations which can be updated instantly at any location.

Data is decentralized since it is in multiple places at once. Thus, becomes a secure network as data cannot be modified without all approval of all the members and makes it difficult to hack.

Information is constantly monitored which makes it difficult to change data and ensures that the information is distributed but not copied.

Agreements become mutual and documented which enhances security and traceability as transactions are logged into the ledgers which reduces the worry of parties keeping their end of the deal.

This results in lower costs, improved efficiency, increased transparency and increased trust.

Blockchain enables users to record and store data more easily and in a decentralized way which allows for transparency from all parties, accurate/real-time data, and improved traceability from production to delivery. Currently most companies manage their data individually on independent software support systems. The information is not shared across platforms which can cause confusion and miscommunication when the information does not align. Now, imagine the ability to track end-to-end performance of your goods and trust in the data being viewed. Blockchain provides exactly that solution. Participants in the network will provide information that would be difficult to change. The transparency allows anyone to audit any point in the supply-chain and reduce errors. Goods come as expected and as a result, increase trust amongst parties and reduce operation costs.

So Why isn’t Blockchain Used More?

A study published in 2020 in the Journal of International Trade and Commerce, delved into the blockchain adoption focusing on Port of Busan and Port of Incheon. Despite all the possible applications of blockchain, the finding suggest it may be more difficult to sell than people think.

Logisticians have difficulties getting a clear idea on the benefits and successful blockchain adoptions.

Consultants and academics worry about the technological maturity of blockchain.

Competitive edge of the industry is highly influenced by economic factors related to financial and time-related aspects.

Blockchain Takes a Huge Shift in Infrastructure to Implement

Blockchain performs its best with more participants because there is more information. Without participants, the use case of blockchain no longer becomes applicable. Therefore, a decent size number of entities must agree on implementing blockchain which is harder than it sounds. Blockchain requires a huge shift in infrastructure. Instead of storing information on their own subscription platform, the information will instead be widely available to anyone in the network which may be intimidating. Not only that, but the technology is new, and companies are hesitant on uplifting their entire structure. The pilot program by The Port of Rotterdam and Busan has shown that blockchain does perform up to expectation, but only provides a single example of the tangible benefits of adoption. A few ports have started pilot testing since, but until we see more entities willing to integrate this technology, it will be a long time till we see any major shifts in supply chain management.

Blockchain is the Future of Logistics

As supply chains become increasingly complex to meet the needs of consumers, the benefits of blockchain are far too good to not be considered as a solution. Not only does it provide relief to cumbersome problems in logistics, but transparency is becoming an important factor to consumers. Ethical sourcing and detailed package tracking are just a few factors that consumers are starting to consider. Blockchain allows for trusted end-to-end product visibility, which will become more vital to companies and consumers alike.

Supply Chain Network Optimization – How to Do it Right

The time is right to re-align your Supply Chain Strategy, for many reasons including:

Logistics and fulfillment are the new storefronts and sales tools

The explosion of direct-to-consumer business forces all companies to have an omnichannel strategy.

The sourcing landscape is rapidly changing with more near-sourcing and risk minimizing.

Sustainability awareness is increasingly unavoidable - and transportation is a big piece.

The time is right to re-align your Supply Chain Strategy, for many reasons including:

Logistics and fulfillment are the new storefronts and sales tools

The explosion of direct-to-consumer business forces all companies to have an omnichannel strategy.

The sourcing landscape is rapidly changing with more near-sourcing and risk minimizing.

Sustainability awareness is increasingly unavoidable - and transportation is a big piece.

The traditional approach very often leads to more of an endless data crunch and, in best case, a mathematical answer that minimizes the theoretical logistics costs but does little to create an implementable supply chain strategy.

But you don’t do a network optimization to relive the linear programming classes from college and show your mathematical acumen. Well, some of us may. For the rest of you, here are some crucial hard-earned learning points from many network optimization projects:

1. Avoid Spending Time and Money Feeding the Monster with Data

Nobody has perfect data. A proper strategy for cleaning and curate the data will be one key to the success of the project.

The important thing is to know what data really matters and how to curate the imperfections into a usable dataset. The most critical data for the outcome is the shipment data and it is often the hardest data to get. If you don’t have access to this data internally, the carriers do have it. They are not always keen on sharing it, but they are still the best source. The order data is usually readily available and can be used to recreate shipments though the dim/weight can complicate things. This is an area where data-enrichment from firms specializing on this can work and also item profiling to reduce the complexity to where it matters.

Most advanced models require much more data to run, but the impact of other data is less critical and can in many cases be handled with benchmarks to get a starting point and sensitivity analysis where you rerun the model with the critical datapoint varied until you find the breaking point where the recommendation changes. It is much easier to make a call when you see where it really matters and have clear choices.

2. The model will not give you a strategy. It will only tell you which alternative is mathematically the best.

Before you run the model; use the data that has been collected to profile your supply chain. This will enable you to evaluate relevant solutions.

Customer profiles and requirements: Delivering to the big retailers demands a different solution than direct to consumer deliveries. Two separate networks?

Inventory profile: Certain products may have demand patterns very tilted geographically or being critical from a supply perspective. Slow-movers vs best sellers. Examples of facts that would determine the eligible alternative network structures to optimize such as Central DC, Regional DCs, Satellites, Forward Stocking Locations, etc.

Order profile, supply profile, product profile are other examples of facts that are important to analyze pre-modelling.

3. Sensitivity Analysis

Instead of trying to create the perfect dataset. Use the model to find out with what value on critical but uncertain data that the recommendation changes. This saves a lot of time and makes the decisions relevant.

4. Use the Right Software Tool for your Challenge

The most advanced optimization tools are expensive and require a lot of effort to configure. You’ve spent a lot of time and money before you are ready to run the model. This is totally worth the investment if your supply chain is very complex and you intend to, once configured, use the model frequently. Those software tools are sophisticated and awesome with all their possible add-ons.

Most companies have a more straightforward supply chain or can optimize the network in North America, or Europe, Asia, etc. separately and then piece them together. If this is the case, the most complex tools are complicating things without the added value. Spend the time and money you save on an adequate optimizing tool to focus on strategy development instead.

Supply Chain Management Post-Covid-19 – Regional Supply Chains

Regional supply chains, near-shoring manufacturing, inventory management, warehousing as a market tool: oldies but goodies are making comebacks in the new, post Covid-19 world.

Regional supply chains, near-shoring manufacturing, inventory management, warehousing as a market tool: oldies but goodies are making comebacks in the new, post Covid-19 world.

Life has changed drastically the last few months since this novel coronavirus disrupted the world as we knew it. Supply Chain Management is making a comeback on what is trending after its last visit on the charts back in the last century.

The trend from global to regional supply chains has been going on for a while. One reason is of course President Trump’s trade war with China. Interestingly, this has demonstrated more of the difficulties to relocate complicated supply chains from the dominating supplier clusters in China. There are so many components only available there that it is not only cost-prohibitive to moving technologically complicated production to North America or Europe. China is very deliberately undergoing a Japanization, in the sense that it used to be the place where all the cheap, low quality stuff was made and now it is becoming the high-tech hub. The tariffs and trade frictions have anyway started a motion towards more regional supply chains.

It has also demonstrated how developed the regional supply chains in east Asia are. China’s Silk Road project will undoubtedly exacerbate the growth of the Greater China supply chains. The main market may well be in Asia.

The tariffs and the COVID-19 crisis have brought the forgotten artform of scenario planning and risk mitigation back into the supply chain management world. Check in with the Site Selection Guru Bob Hess at Newmark for details on how to do this.

One answer to the risk mitigation is “near shoring” – regional supply chain in the own country or a safe region i.e. within EU or within the USMCA block. Establishing safe and resilient, regional supply chains for medical equipment is on top of many procurement specialists’ agenda.

We know from our clients with assembly/production in North America that a lot of companies are trying to find or develop suppliers of critical components within the USMCA. This is a process that takes time and the result will not be visible short-term but certainly over time. Most likely is that this will materialize in the form of regional clusters like you see for furniture in Western Michigan, cars in the Midwest or pharmaceuticals around Boston and Raleigh.

A third area for regional supply chains is products that can be made by robots or other forms of automated production. This is driven by the increasing salaries in China and the decreasing costs for robots combined with the ever-increasing capabilities and versatility they have. We see more and more very successful and growing companies built on automated production in both Europe and North America. It is not far-fetched that they will help form the foundation for regional supply chains.

The most important factor driving the growth of regional supply chains is psychological and materializes in attitude. Where offshoring to low-cost China was a default in the 1990s and 2000s, it is now mainstream to think sustainability, resilience and creativity. Enter regional or even local supply chains. Farm-to-Table or Made-in-your-County.

Supply Chain in COVID-19: The Option of Nearshoring

Our CEO, Håkan Andersson, was recently featured on a podcast with industry expert, Bob Hess, about the potential for #nearshoring as a result of the pandemic. Listen here: https://nkf.re/3dhqU0

Our CEO, Håkan Andersson, was recently featured on a podcast with industry expert, Bob Hess, about the potential for #nearshoring as a result of the pandemic.

Listen here: https://nkf.re/3dhqU0

Canadian Distribution Strategy for U.S. Organizations

For many American companies, Canada can be an afterthought considering its small size relative to the US. However, given its intricacies, it would be a mistake for American companies to assume that Canada is much the same as the US as the Canadian market and topography is very different from that of the United States. The key to unlocking the best Canadian distribution strategy is to understand these differences.

For many American companies, Canada can be an afterthought considering its small size relative to the US. However, given its intricacies, it would be a mistake for American companies to assume that Canada is much the same as the US as the Canadian market and topography is very different from that of the United States. The key to unlocking the best Canadian distribution strategy is to understand these differences.

Canada’s population is 11 percent of the U.S. population based on 2015 data, despite being nearly 25% larger than the contiguous lower 48 United States (38.85 MM square miles vs. 31.12 MM square miles). The Canadian population is primarily inhabited near the continental U.S. border which is 3,987 miles long, as the population map below shows:

Map created in Tableau. Data source: http://www12.statcan.gc.ca/census-recensement/2011/dp-pd/hlt-fst/pd-pl/Table-Tableau.cfm?T=301&S=3&O=D

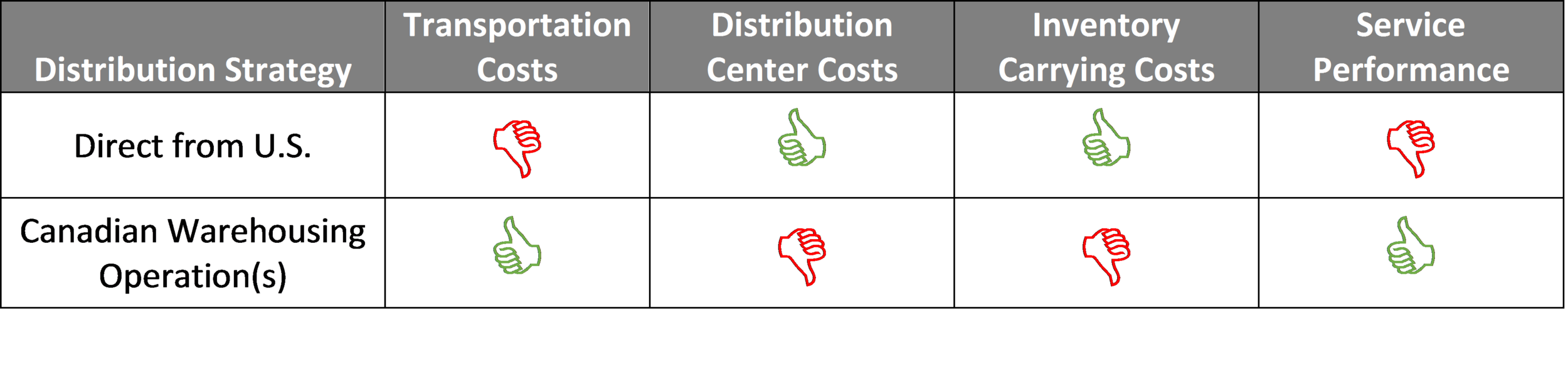

The distribution to Canadian customers can be complex as a result of market, distance, regulations and tax requirements. However, many companies have evaluated their options and selected one of the following distribution strategies either shipping direct from U.S. or establishing warehousing operation(s) in Canada. The selection of which distribution is right depends on a number of factors, such as:

Sales volume

Service requirements

Distribution center costs

Transportation costs

Inventory carrying costs

Type of customer

Etc.

Here are some high-level benefits/disadvantages depending on the strategy:

What Happens When a Company’s Logistics Network Is Optimal?

It is hard to believe, but it does happen once in a while, exactly twice in the 15 years of doing supply chain network strategy work for numerous of companies in different industries, when a company’s logistics network is optimal even though it has not been reviewed holistically for at least 5 years.

It is hard to believe, but it does happen once in a while, exactly twice in the 15 years of doing supply chain network strategy work for numerous of companies in different industries, when a company’s logistics network is optimal even though it has not been reviewed holistically for at least 5 years.

Most companies perform logistics network studies to identify opportunities to reduce costs and improve service and instinctively think relocation. However, at times, this is not the result. There are a number of other opportunities to reduce the logistics costs and improve service performance without relocating a warehouse/distribution center.

The companies who have optimal supply chain/logistics network do benefit from performing a supply chain/logistics network evaluation work. The in-depth process provides an opportunity to identify short- and long-term improvements as well as allows the corporation to realign its goals and objectives across departments on how to best serve its customers today and for the next five years. Typical benefits/ improvements include:

Reevaluation of the current S&OP policies and procedures.

Benchmark (costs, productivity and efficiency) of warehouse(s)/distribution center(s).

Benchmark transportation rates and audit transportation policies and procedures.

Identify transportation mode changes.

Evaluate inventory deployment strategies.

Renegotiate customer requirements.

Redefine shipping policies to customers.

Other

These benefits, at times, are significant impacting the company’s bottom line immediately.