Interview: Conrad Ross Discusses Pharma Supply Chain Improvement Opportunities

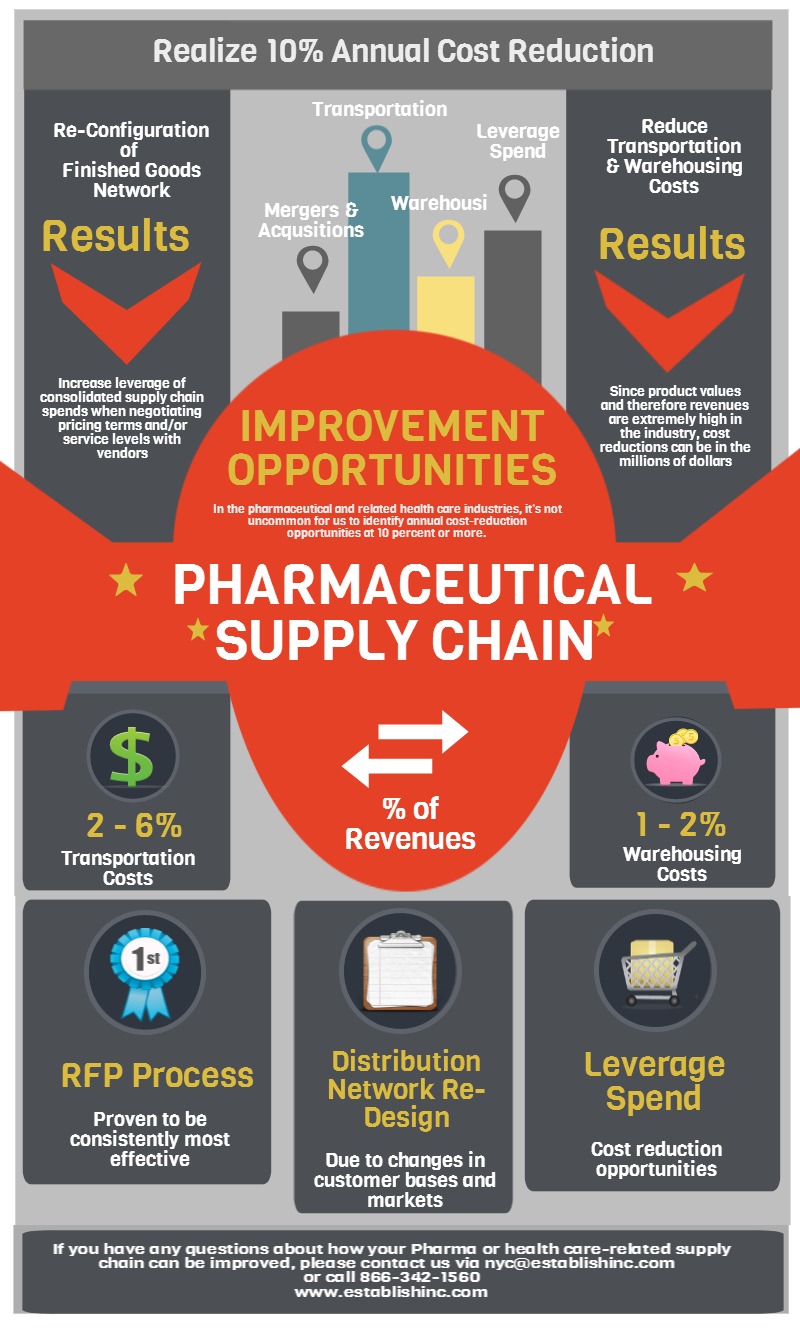

In the following video Conrad Ross from Establish discusses the opportunities for improvements in the pharmaceutical and healthcare supply chains. What Conrad has noticed is that in the pharmaceutical and related health care industries, it’s not uncommon for us to identify annual cost-reduction opportunities at 10 percent or more.

Why the Pharmaceutical Supply Chain Needs to be Improved

Hey, Dustin, this Conrad Ross with Establish. I’m calling in response to the question why the pharmaceutical supply chain needs to be improved. Particularly, what are the improvement opportunities in the pharma supply chain? I haven’t talked to you in a while, and I do wish you a Happy New Year. What I’ve noticed is that in the pharmaceutical and related health care industries, it’s not uncommon for us to identify annual cost-reduction opportunities at 10 percent or more. These opportunities are typically found in the configuration of a finished-goods network and transportation and warehousing.

Configuration of Finished-Goods Network

Now, to get specific about mergers and acquisitions. Pharmaceuticals can grow organically by acquisition or by some combination of the two. By “acquisition,” I mean by acquiring other companies and also by acquiring products. Those that are grown by acquisition sometimes, for a variety of reasons, do not always fully integrate the acquisitioned companies’ supply chain purchasing functions into their own. If they were to do so, it would enable them to increase the leverage of their consolidated supply chain spends when negotiating pricing terms and/or service levels with vendors; “vendors” meaning carriers, 3PLs and 4PLs, suppliers, and so forth.

Companies that have grown rapidly by acquisition typically contain significant opportunities to increase their spend leverage and, consequently, reduce their supply chain costs. Leveraging of spends and vendor negotiations, however, is not limited to companies that have grown by acquisition. Companies that have grown organically can also obtain similar cost-reduction opportunities, as can companies that are downsizing. There are many ways to increase the spend levels and, as a result, include vendor negotiations. For example, companies seldom separate the transportation cost contained in the landed cost in their raw materials. Therefore, they miss the opportunity to leverage this spend with the finished-goods spend when negotiating carrier-agreement rates.

In addition, we sometimes find that there are missed opportunities for incorporating transportation costs associated with the transfer of WIP inventories of finished goods into the combined transportation spend. Companies need to look carefully at their entire transportation spend from end to end so that they can capture their best opportunities for leveraging their spend. Beyond levering spend, changes in manufacturing locations, product mixes, customer bases, and related service requirements in transportation warehousing costs always occurring. The finished-goods logistics networks continually need to be evaluated to be certain that they remain efficient and relevant. The configuration of most networks require at least some modifications every 5 years.

Transportation Costs

Transportation costs in a pharma company typically average 2 to 6 percent of revenues, depending on the modes and classes of service used. Since product values and therefore revenues are extremely high in the industry, cost reductions can be in the millions of dollars and sometimes even in the tens of millions of dollars. I think this identifies, Dustin, the potentials for improvement to savings.

Warehousing Costs

Warehousing costs typically average 1 to 2 percent of revenues. While it’s difficult to change third-party warehousing providers, it’s important to know that their costs are in line with the industry. If a new agreement is being negotiated, it’s equally important to know that their proposed costs will also be in line with the industry. Benchmarking warehousing costs and practices is an effective way to make this determination. Another way is to obtain cost through a formal request for proposal, the RFP process. Either method—benchmarking or the RFP process—can be effective. We’ve found that the RFP process is consistently the most effective for a number of reasons.