THE SUPPLY CHAIN BLOG

Canadian Distribution Strategy for U.S. Organizations

For many American companies, Canada can be an afterthought considering its small size relative to the US. However, given its intricacies, it would be a mistake for American companies to assume that Canada is much the same as the US as the Canadian market and topography is very different from that of the United States. The key to unlocking the best Canadian distribution strategy is to understand these differences.

For many American companies, Canada can be an afterthought considering its small size relative to the US. However, given its intricacies, it would be a mistake for American companies to assume that Canada is much the same as the US as the Canadian market and topography is very different from that of the United States. The key to unlocking the best Canadian distribution strategy is to understand these differences.

Canada’s population is 11 percent of the U.S. population based on 2015 data, despite being nearly 25% larger than the contiguous lower 48 United States (38.85 MM square miles vs. 31.12 MM square miles). The Canadian population is primarily inhabited near the continental U.S. border which is 3,987 miles long, as the population map below shows:

Map created in Tableau. Data source: http://www12.statcan.gc.ca/census-recensement/2011/dp-pd/hlt-fst/pd-pl/Table-Tableau.cfm?T=301&S=3&O=D

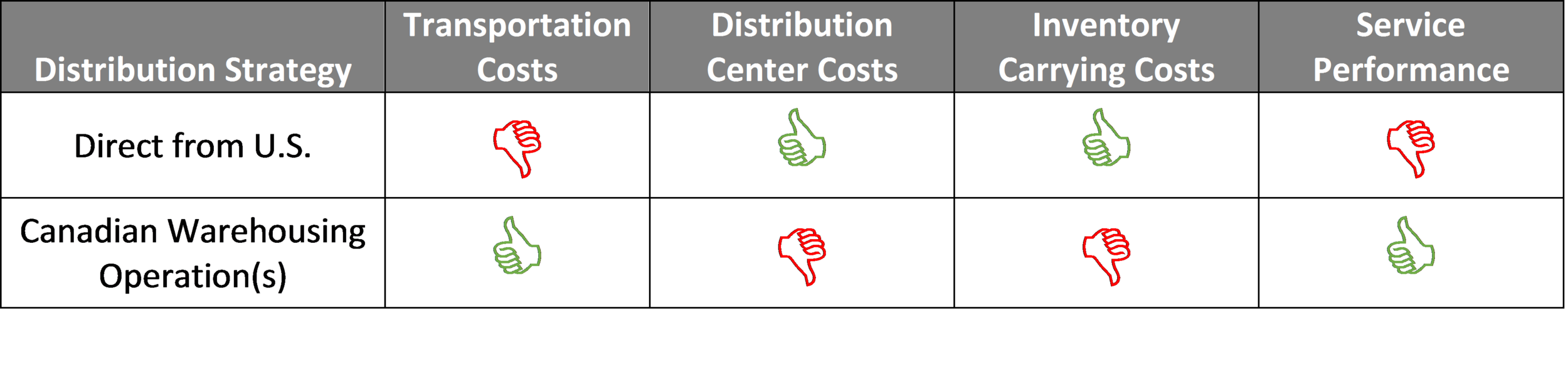

The distribution to Canadian customers can be complex as a result of market, distance, regulations and tax requirements. However, many companies have evaluated their options and selected one of the following distribution strategies either shipping direct from U.S. or establishing warehousing operation(s) in Canada. The selection of which distribution is right depends on a number of factors, such as:

Sales volume

Service requirements

Distribution center costs

Transportation costs

Inventory carrying costs

Type of customer

Etc.

Here are some high-level benefits/disadvantages depending on the strategy:

Revenues from Logistics and Supply Chain

Logistics and supply chain can be a game changer in terms of creating new revenue for your company. If you break free of the silo thinking you may see ways to use logistics to make more money.

Logistics and supply chain can be a game changer in terms of creating new revenue for your company. If you break free of the silo thinking you may see ways to use logistics to make more money.

Turning the Supply Chain into a Revenue Chain

Back in 2001 Harvard Business Review was already talking about ways to make money through supply chain. One example noted was laser surgery to correct myopia. Several of the companies that make the necessary equipment have chosen to share the revenues of doctors and clinics performing the procedures instead of extracting all their profits by selling the equipment outright.

Source: https://hbr.org/2001/03/turning-the-supply-chain-into-a-revenue-chain

6 Ways Supply Chain Visibility Can Increase Revenue

Supply chain execution has become a competitive differentiator in many industries. By integrating supply chain capabilities into product development and marketing strategies, organizations can often create new revenue sources or business models.

Source: http://www.socialsupplychains.com/6-ways-supply-chain-visibility-can-increase-revenue/

Strong supply chains increase revenue and profit

Business model innovations focused on improving networks, processes, services or channels can have significant and sustainable impact on the revenues of company. Focus on your supply chain as part of the business model of the firm.

Source: http://www.supplymanagement.com/news/2014/strong-supply-chains-increase-revenue-and-profit

Seven Trends in Logistics

Warehousing; In-House or Outsourced? On one side, the 3PL providers are getting better and have all the credentials needed, which is tearing down a lot of the walls of resistance towards outsourcing. On the other side is the feeling of lost control and freedom that could be needed as logistics is getting even more important. There are a lot of other reasons, but everybody is talking about it.

1. Warehousing; In-House or Outsourced?

On one side, the 3PL providers are getting better and have all the credentials needed, which is tearing down a lot of the walls of resistance towards outsourcing. On the other side is the feeling of lost control and freedom that could be needed as logistics is getting even more important. There are a lot of other reasons, but everybody is talking about it.

2. Ocean Freight

At CSMCP this was the topic for of many discussions and it is changing the thinking in many companies. The intensive rate hikes the last year and the unreliable capacity are some of the problems to wrestle with. It is also a part of the background to the on-shoring, even though it is more anecdotal than substantial statistical facts this far. On-shoring will make the list soon.

3. White Glove Services

The term used to refer to companies carrying the furniture into the living room. Now it is often used to refer to the value added services in conjunction with the delivery of a physical product. This service is getting more integrated in the physical product and treated more as a source of revenue than a nuisance. The final yards of the delivery is getting more important as the only physical contact with the customer for many companies.

4. S-a-a-S

The Software-as-a-Service concept has enabled smaller companies to operate good and modern WMS and TMS, which facilitates a smaller revolution when it comes to efficiency.

5. Intermodal Traffic

It has been talked about for a while and now nobody wants to miss the train (!) The increase in domestic container shipments on rail increased by 7% in the third quarter of 2014 over the same quarter in 2013 according IANA.

6. Fuel Prices

The gas price has decreased by 78 cents per gallon from May 2014 to November 2014. What will this mean for the trucking industry? Will the carriers change the fuel surcharge formulas?

7. Distribution Structures

Partly connected to the number 1 on the list. With the economy taking off and volumes increasing, we see a lot of companies reevaluating their distribution networks. The managements have learned that there are big savings to be had by optimizing the distribution networks and don’t want to miss out.

Internal Business Partnering in Procurement

Dustin Mattison interviewed Bill Young. Bill discussed Internal Business Partnering in Procurement.

Dustin Mattison interviewed Bill Young. Bill discussed Internal Business Partnering in Procurement.

Internal Business Partnering

Bill believes Internal Business Partnering is important because category management has been mainly about cost reduction and a lot of companies have been through at least one, two, sometimes three phases of category management. The result is that they have plowed the fields and saved a lot of cash. Now purchasing is starting to look at how it can create value, as well as just reducing costs. In order to do that, they need to be much, much closer to their internal clients, but some of those internal clients are suspicious of purchasing because they have some experiences of having their budgets raided. Bill says that purchasing has perhaps a little bit of ground to catch up on before it’s fully trusted as a business partner.

Internal Business Partnering is really a form of consultancy. It’s being the expert on how supply markets work; what you can get out of supply markets; how you can manage them better; how you can improve their efficiency and effectiveness; how you can extend the resources of the organization beyond its direct employees and into the companies that provide it with important services; extending the scope of the resources of a company.

According to Bill what we’re seeing is that IT departments in many companies have already taken purchasing back into their function. You can see companies where they have IT strategic sourcing managers in effect doing exactly what purchasing wanted to do and used to do, and they’ve hollowed out that bit of procurement. The same could be happening in HR, where, if you look at the average HR department, approximately fifty percent of everything they provide to the business is actually coming from external suppliers. They need to have some sort of core competence within the HR function and managing those suppliers, and they’re asking, “Why would we get procurement to do this if it’s so important?” The future of procurement depends on stepping up to the plate and learning how to do this business partnering; otherwise, some of these departments are gonna take it in-house, as IT already has done.

His recommendations are that companies should obviously think hard about Internal Business Partnering in Procurement. It tends to be the service companies that are pioneering this area, and they include the advertising companies, the media companies, a lot of the Internet companies. In fact, Bill saw recently a job description for what looked to any other company like a category procurement manager at Amazon. The words procurement, purchasing, and buying didn’t appear in the job description. He thinks the next stage is going be the high-service companies but still with manufacturing elements, especially pharmaceuticals. They should be looking hard at this area and looking at the transition. The interesting thing will be for a lot of companies who never really fully embraced category management, can they go straight from classical procurement to value procurement? Some have but it’s a big step. So, looking at this area, looking at the skill levels and facing the challenge, that’s the next phase.

About Bill Young

Development of Sales and Procurement Capability

Questions To Ask When Collaborating With Suppliers

Dustin Mattison interviewed Sara Husk. Sara discussed collaboration with suppliers and customers.

Dustin Mattison interviewed Sara Husk. Sara discussed collaboration with suppliers and customers.

Sara works for a company called Imaginatik. Imaginatik specializes in providing innovation infrastructure both from a technical and services perspective, primarily to Fortune500 companies. Sara works with a lot of companies on their innovation program on a day to day basis.

One of the things Sara and her team is noticing is that companies increasingly want to go outside of their four walls to collaborate, innovate and develop new things. This can be with customers, suppliers or vendors. They really want to get the most that they can out of the entire group they are working with. It can be partners, universities, community groups, state regulatory groups, etc. These things can all help bring value back to the company.

The first things Sara usually asks are “why do you want to get into this?”, “what is it you are hoping to gain?”, “what does success look like?”, “what are those intangible outcomes?”.

The tangible outcomes might be to get some type of new way of manufacturing a part. Intangible might be to build a strong relationship with suppliers so that they bring some of their best and creative ideas.

You are also looking at things like why you want to be the brand of choice in the marketplace to be the group to collaborate with. You also need to think about who owns the outcome and how to handle these types of pieces as well. There is a lot that goes into it in terms of the thought process up front.

There are a lot of things that are involved with thinking this whole thing through. You need to ask questions such as: How do you get people aligned with you? How do you get people participating with you? What is in it for the other parties?

Lean Supply Chain & Logistics Management

It seems that there has always been a focus on cost cutting in the Supply Chain & Logistics function. This focus is due to the very real “leverage” effect that reducing operating costs can have on the bottom line. This strategy has been somewhat successful, but has left a lot on the table in terms of not only cost reduction opportunities but productivity and quality as well.

It seems that there has always been a focus on cost cutting in the Supply Chain & Logistics function. This focus is due to the very real “leverage” effect that reducing operating costs can have on the bottom line. This strategy has been somewhat successful, but has left a lot on the table in terms of not only cost reduction opportunities but productivity and quality as well.

In the past five years or so, the philosophy of “Lean Manufacturing” has been grown to include the Supply Chain & Logistics function and can enable management to attain the improvements mentioned above.

So what is Lean all about and how can it help you? In a nutshell, Lean is a team-based form of Continuous Improvement which focuses on identifying and eliminating waste from the customer’s viewpoint. Waste is defined as activities that do not add value to the customer. After all, the customer is ultimately paying for the end product (or service), which to them is the value added effort of transforming raw materials into finished goods. Activities that don’t add value to the customer such as production being stored, inspected, or delayed, products waiting in queues, and defective products do not add value; and as a result, they are 100% waste.

In fact, in most Supply Chains (more like Supply “Web” when you think about it), the full “cycle time” or the time material or information enters it until it exits it to the customer, is primarily non-value added or waste. Very little of this time is actually value added from the customer’s viewpoint (referred to as “processing time”). This cycle time is referred to by many in Lean manufacturing as “dock to dock” time. The shorter the “dock to dock” time, the more Lean your manufacturing process is. The same can be said in terms of your Supply (and Demand) Chain.

In Lean terms, Supply Chain & Logistics areas are frequently viewed as a “box” (i.e. one activity such as warehousing) or a “line” (i.e. transportation) on a Value Stream Map, which is a form of process flow mapping unique to Lean which separates value added and non-value added activities starting at the customer and working its way through your system back to the supplier. It is only recently that Supply Chain & Logistics practitioners have started to adopt Lean principles and tools to analyze and improve this critical area.

There are many concepts and tools that are in the Lean practitioner’s toolkit that can be applied to your Supply Chain & Logistics function. Many are relatively simple and easily understood such as 5S-Workplace Organization, Visual Workplace and Layout. Others have greater complexity such as Batch Size Reduction, Quick Changeover, and Total Productive Maintenance (equipment related waste) for example. All require ongoing training, support and commitment from both management and the rank and file.

To get started, at the very least, requires a fundamental understanding of what is non-value added or “waste” from the eyes of the customer (both the ultimate customer and the people downstream from you who you are giving material or information to) in order to start down the path ofeliminating or at least reducing the identified waste.

The “Seven Wastes” as described by Taiichi Ohno of Toyota includeTransportation, Inventory, Motion, Waiting, Overproduction, Overprocessing and Defects. A good way to remember these wastes is the acronym “T.I.M. W.O.O.D.”. Many people, including myself include an Eighth waste of Underutilized Employees or Behavioral waste.

It’s not really “rocket science” and in fact, once you and your team start thinking in this way, you’ll wish you started on the Lean journey sooner!

In the upcoming months, I’d like to delve into each of the Eight Wastes in this column and relate them to the Supply Chain & Logistics function to help practitioners start to “wrap their head around” this valuable tool as it’s not a “fad” and is truly here for the long term. It’s important to realize that, when successfully implemented, Lean can be a competitive weapon which can be a great advantage in these tough economic times.

In the next blog we’ll start with perhaps the largest waste, and one that covers much variability and drivers of waste…Inventory.

Optimizing Linear Networks

Dustin Mattison from TheFutureOfSupplyChains.com interviewed Fernando Alvarez, who discussed ‘Optimizing Linear Networks’.

Dustin Mattison from TheFutureOfSupplyChains.com interviewed Fernando Alvarez, who discussed ‘Optimizing Linear Networks’.

Logistics Network Modeling can help you evaluate trade-offs between service level and cost in your logistics network. Optimizing your logistics network can be a complex problem to solve. You need qualified supply chain consultants who know how to devise proper algorithms to solve specific logistics network design problems. The end results will include cost savings and better service levels.

Key Takeaways

- Today the top 100 liner companies running fleets of about a dozen vessels or more are basically developing their schedules and rotations by hand, or using Excel.

- This creates tremendous sub-optimality in their system.

- Using optimization you can transport the same number of containers at very high levels of service, but with lower bunker consumption and fewer vessels.

- It would be very easy to design a network that is extremely cheap, but that would provide a very low level of service to the shipper. At the same time it would be very easy to design a network that provides an extremely high level of service to the shipper, but that would come at a very high cost.

The interview in its entirety can be seen here.

About the Author

Dustin Mattison | Blogger on TheFutureOfSupplyChains.com

About the Interviewee