THE SUPPLY CHAIN BLOG

Ensuring a Successful Supply Chain Network Optimization Study

We previously wrote about some of the reasons and incentives for why a company would want to execute a supply chain network optimization study. Now, we would like to discuss some of the key contributing factors to consider when completing the supply chain network optimization study that will ensure both realistic and usable results.

We previously wrote about some of the reasons and incentives for why a company would want to execute a supply chain network optimization study. Now, we would like to discuss some of the key contributing factors to consider when completing the supply chain network optimization study that will ensure both realistic and usable results.

Modeling Tools

A supply chain network optimization study cannot be completed without using a supply chain modeling software tool. Modeling tools will be able to handle all the necessary data and backend calculations so that the user can focus on having the right inputs and interpreting the outputs. There are many different tools out there that will get the job done and each one has different pros and cons. Some of the main ones today include Supply Chain Guru, Blue Yonder and AIMMS, as well as our internal proprietary tool, ASSIGN.

Data

We talked about the multitude of data analysis that will be delivered during a supply chain network optimization study, but data will also be the major input that drives the model and strategy development. That being said, it is important to spend a large amount of the time up front focusing on the data. Collecting the right data and making sure the data is of reliable quality will determine how complex and detailed the study can get. The most important data to look at includes transportation/shipment data, sales order history data and inventory data. Getting all the supply chain cost elements (in particular, warehousing costs) will also be important for establishing the baseline costs. Because the data being used will be very granular, validating the data against financial reports is another extremely important step to ensure the data driving the project is correct and the project’s results, are therefore, realistic.

Business Rules & Constraints

While data is the most important factor during a supply chain network optimization study, the business rules and constraints should not be overlooked. This will be what restricts the model and ensures that the results are optimized to support the goals of the business. Business rules and constraints refer to parameters like a min or max inventory on hand and order fulfillment time (e.g. customers receive goods within 4 days) and should be discussed in the beginning of the project and updated as necessary. With the right software tool, these can be put right into the model.

Forecasting and Planning Factors

When reviewing the results of the supply chain network optimization study, it is important that they not only will work for the business as things are today but also will support the business over the next 5 years and beyond. That is why it is important to consider the demand forecast (as detailed or generic as it may be) and any planning factors. Planning factors are things that won’t be seen in the data, but should be considered, and can be anything from the opening/closing facility to tariff increases to needing a distribution center to be within a certain distance of a specific location. Ensuring that the forecast is properly understood, and all the planning factors are laid out early in the project, will be vital to feasibility of the results at the end of the project.

What are the Benefits When Completing a Supply Chain Network Study?

It does not matter if a company is business-to-consumer (B2C), business-to-business (B2B) or direct-to-consumer (DTC), if the company distributes goods, then the supply chain will play a vital role. That being said, it is important for companies to be active when reviewing their supply chain network to ensure that it is set up optimally to support the business. We find that supply chain costs usually account for over 6-10% of sales, which can add up to a lot of money for large companies. Likewise, it is just as important for smaller companies to prioritize their supply chain strategy, as they may quickly and consistently outgrow or shift their current supply chain networks.

It does not matter if a company is business-to-consumer (B2C), business-to-business (B2B) or direct-to-consumer (DTC), if the company distributes goods, then the supply chain will play a vital role. That being said, it is important for companies to be active when reviewing their supply chain network to ensure that it is set up optimally to support the business. We find that supply chain costs usually account for over 6-10% of sales, which can add up to a lot of money for large companies. Likewise, it is just as important for smaller companies to prioritize their supply chain strategy, as they may quickly and consistently outgrow or shift their current supply chain networks.

One of the best ways to review the current supply chain strategy and determine how it can be improved is by doing a supply chain network study (aka supply chain network design or supply chain network optimization), which consists of loading data into a supply chain modeling software to test out different scenarios against the current supply chain (baseline). There are a lot of benefits that can come from doing a supply chain network study and some are more obvious than others.

Data Analysis

Every supply chain network study starts with lots and lots of data. This data will be used in more than one way throughout the study. In addition to being what drives the model, there are loads of analysis that take place in the beginning portion to understand the business and see what sort of inventory and distribution strategies make sense. We find that most of the time our clients do not have the time or resources to complete detailed analysis on a consistent basis so usually a lot is learned before the network modelling even starts. This can pinpoint areas for the company to focus on outside of the supply chain network study and lead to the development of different supply chain strategies that were not thought of previously.

The Baseline

Creating a digital replica of the current supply chain network costs, known as the baseline, is another major portion of the supply chain network study. This will show the current nodes or locations involved in the supply chain and all of the supply chain related costs. This information will give a good indication of where the highest costs are and be the starting point for comparing alternatives. In addition to costs, the baseline will also give a look into the current service levels being achieved, a visual representation of ship patterns, and a look at volumes vs capacity to see what areas of the supply chain might be strained.

Center of Gravity

The center of gravity analysis uses demand data to determine the optimal location or locations for a specified number of DCs. It can be a quick and simple way to answer questions about location and number of locations and will help make decisions when determining what scenarios to run later in the study.

Scenario Comparison

The ability to compare different scenarios without making any physical changes is probably the most significant deliverable when doing a supply chain network study. Once the baseline is created, different distribution strategies and node locations can be modeled to see their impact on costs, service levels, ship patterns and volumes against the baseline. Most scenarios tested should be based on the data analysis that was done, but there is a lot of freedom. If you have ever wondered what would happen if you moved your operation across the country or sourced products from the one country instead of another, a network study can tell you what that would look like.

The Final Deliverables

Supply chain network studies generate a lot of deliverables. The results/answers will be based on what is important to the business. Some companies might prioritize 2-day shipping where others want to minimize costs and improve bottom line. Regardless of the main goal, the supply chain network study offers insight into a variety of considerations, such as sourcing, distribution and inventory strategy including number of distribution centers, distribution center location(s), ship patterns and what to store where. This information can help make key strategic decisions for the supply chain and the business as a whole.

Circular Supply Chains - A Step Towards Sustainability

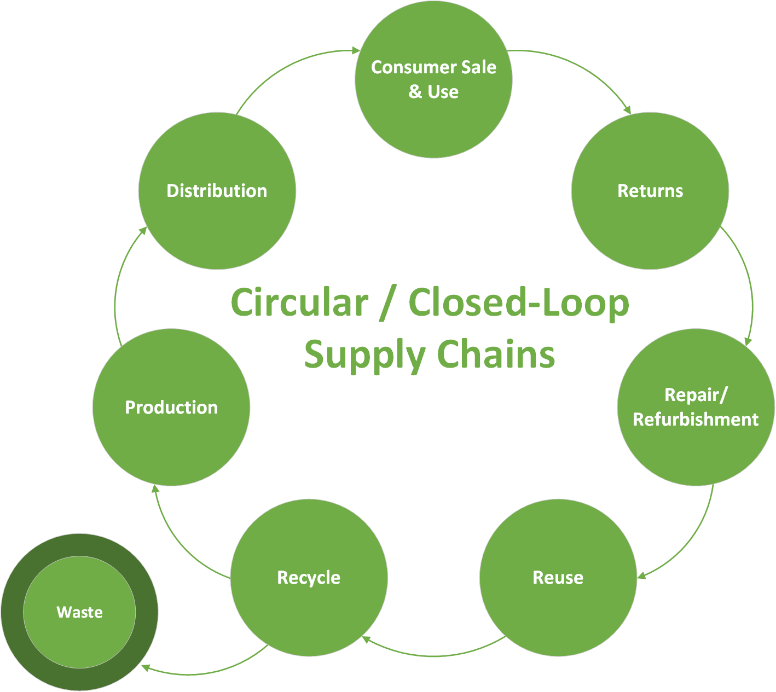

Building upon last week, we are taking a deeper dive into the sustainability movement of circular (a.k.a closed-loop) supply chain practices. The world is moving on from the 'cradle-to-grave' supply chain practice of product manufactured, distributed, used and thrown out. Circular supply chains can be described as the combination of standard logistics and reverse logistics in order to create a circular logistical lifecycle. Products in the reverse logistics flow can be redistributed, repaired for continued use, remanufactured in case of defects, or recycled into parts and materials that have been carefully selected for this purpose.

Building upon last week, we are taking a deeper dive into the sustainability movement of circular (a.k.a closed-loop) supply chain practices. The world is moving on from the 'cradle-to-grave' supply chain practice of product manufactured, distributed, used and thrown out. Circular supply chains can be described as the combination of standard logistics and reverse logistics in order to create a circular logistical lifecycle. Products in the reverse logistics flow can be redistributed, repaired for continued use, remanufactured in case of defects, or recycled into parts and materials that have been carefully selected for this purpose. This diagram maps out what a circular supply chain could look like:

Completely closing the loop is an incredibly ambitious goal - zero-waste is no simple task. Significant motivations for circular supply chain economics include the following:

1. Recovered product reduces waste, minimizes direct costs and offers secondary value. Waste reduction is clear - less product heads to landfills when its return is incentivized. Direct costs can be avoided by reusing product as input to production. Finally, secondary value is achieved through sale of recovered outputs on secondary markets.

2. Improved brand-image and customer loyalty. Circular supply chains, and sustainability in general, are mainstream - an outwardly sustainable company earns positive publicity. Returns, repairs, and refurbishment allow for consistent warranty practices that earn customer loyalty and future sales.

3. Product improvement through more data. With more products returning to producer's hands, the entire product lifecycle can be mapped out and defects, usage, and feedback can be utilized to improve product design.

Case Study: IKEA Furniture

In the last 10 years, patience as a consumer has become thin. 'Fast' trends are in - be it 2-day shipping, fast fashion, and even fast furniture. Similar to the way Zara and H&M turned the apparel industry into a race for who could adapt quickly and provide cheap trendy styles, the furniture industry has shifted towards products with a life cycle of 1-2 years. They are low-quality, easy to assemble, and can be left behind when moving residences. IKEA was at the forefront of this trend, and has made significant investment to shift their narrative and lead sustainability initiatives in the furniture industry.

IKEA has explored a multitude of strategies to push towards their goal to be 100% circular using only renewable and recycled materials. Their solutions range from product leasing to secondary markets to using circular materials that can be remanufactured into new products. While the company recognizes its shortcomings - and is realistically very far from their goal - these are big steps for an industry leader and Fortune 100 company to make. Read more about it here.

5 Supply Chain Trends for 2021

This past year has created many new challenges for everyone, causing consumers and companies to adapt. We expect some of the supply chain changes to be temporary but that many of them will have a lasting impact on the supply chain industry going forward. Below, we discuss some of the trends that we expect to see in 2021.

This past year has created many new challenges for everyone, causing consumers and companies to adapt. We expect some of the supply chain changes to be temporary but that many of them will have a lasting impact on the supply chain industry going forward. Below, we discuss some of the trends that we expect to see in 2021.

Fulfillment and Logistics as a Competitive Tool

Every year we continue to see consumer behavior change, and in no year has that change happened as rapidly as in 2020. People want to get quality goods for a reasonable price and quickly. Unorganized supply chains will become increasingly exposed as companies will have to choose between bad service levels or unsustainable costs to meet customer demand. The most obvious example of this trend is Amazon's move to achieve next-day or same-day shipping. As stated above, consumer expectations for service continue to rise. This means businesses that have systems in place to forecast well, stock optimal levels of inventory and fulfill efficiently have a significant advantage over those that do not.

Focusing on E-Commerce, Service Levels and Omnichannel Development

The shift from brick and mortar retail to e-commerce has been growing every year, and COVID-19 only expedited that growth even more. It's no surprise that consumer’s extreme shift to e-commerce seen in 2020 will have a lasting effect on the way people do business moving forward. In addition to the e-commerce shift, service levels are also becoming a higher focus as consumers are going to choose the quickest and most reliable option. To keep up with these shifts, companies are going to have to continue to focus on developing their omnichannel strategy. This means using support systems to create an interconnected network of stores, warehouses and 3PLs, providing the flexibility to fulfill both large wholesale purchases and small e-commerce orders. Companies can then leverage this interconnectivity within the network to optimize fulfillment strategy on an order level basis.

Shifting E-Commerce to a 3PL

Another industry trend we expect to see is a significant shift for e-commerce distribution towards third-party logistics companies (3PLs). The e-commerce industry, in comparison to brick and mortar stores, presents a complexity that is hard to tackle for smaller companies. 3PLs provide an option that will allow companies to set up much quicker than if they opened their own warehouse and allow them to avoid significant fixed costs, have access to an already established network and get specialized processes based on their needs.

Making Procurement a Focus

COVID-19 complications and global trade friction with China mixed with consumer’s increasing expectations for better service have signaled to the supply chain world that now may be the time to focus on procurement. By moving suppliers closer to home (near-shoring) and prioritizing the procurement process to make lead time and flexibility priorities, companies can improve their fulfillment times and overall supply chain. Developing a regional supply chain offers the better potential for mutually beneficial relationships and improves both time and proximity to market. This confidence in relationship management and product could challenge the prior approach of low-cost country sourcing.

Freight Normalization – A New Baselinne

COVID-19 has caused overwhelming increases to volume causing capacities to be tested and costs and rejection rates to skyrocket. As the freight companies profit on these higher rates, it can be expected that they will reinvest into capital expenditures, such as more trucks, increasing capacity to meet market demand and normalizing from the economic shifts of 2020.

We wish everyone a safe and healthy 2021.

Blockchain in Logistics: How it Started and How It's Going

Blockchain’s origin is rooted in the release of the whitepaper written under the name Satoshi Nakamoto explaining the foundation of what we know as today, Bitcoin. Bitcoin offered an avenue to worry-free digital transactions due to transparency and decentralization of the data. This ensured that information could not be altered and prompted the crypto-currency boom. The core-principles of blockchain and success of Bitcoin started a wave of curiosity into other possible applications, thus the development of the technology began to arise. One of these applications was supply chain.

Blockchain’s origin is rooted in the release of the whitepaper written under the name Satoshi Nakamoto explaining the foundation of what we know as today, Bitcoin. Bitcoin offered an avenue to worry-free digital transactions due to transparency and decentralization of the data. This ensured that information could not be altered and prompted the crypto-currency boom. The core-principles of blockchain and success of Bitcoin started a wave of curiosity into other possible applications, thus the development of the technology began to arise.

One of these applications was supply chain. Blockchain emerged and appeared to be the solution to everyone’s problems. In 2019, The Port of Rotterdam and The Port of Busan pilot tested blockchain into their maritime logistics and found success in automation and reducing operation cost.

What is Blockchain? As Explained from Blocklab:

A “digital ledger” or spreadsheet that is duplicated and stored in a distributed network in multiple locations which can be updated instantly at any location.

Data is decentralized since it is in multiple places at once. Thus, becomes a secure network as data cannot be modified without all approval of all the members and makes it difficult to hack.

Information is constantly monitored which makes it difficult to change data and ensures that the information is distributed but not copied.

Agreements become mutual and documented which enhances security and traceability as transactions are logged into the ledgers which reduces the worry of parties keeping their end of the deal.

This results in lower costs, improved efficiency, increased transparency and increased trust.

Blockchain enables users to record and store data more easily and in a decentralized way which allows for transparency from all parties, accurate/real-time data, and improved traceability from production to delivery. Currently most companies manage their data individually on independent software support systems. The information is not shared across platforms which can cause confusion and miscommunication when the information does not align. Now, imagine the ability to track end-to-end performance of your goods and trust in the data being viewed. Blockchain provides exactly that solution. Participants in the network will provide information that would be difficult to change. The transparency allows anyone to audit any point in the supply-chain and reduce errors. Goods come as expected and as a result, increase trust amongst parties and reduce operation costs.

So Why isn’t Blockchain Used More?

A study published in 2020 in the Journal of International Trade and Commerce, delved into the blockchain adoption focusing on Port of Busan and Port of Incheon. Despite all the possible applications of blockchain, the finding suggest it may be more difficult to sell than people think.

Logisticians have difficulties getting a clear idea on the benefits and successful blockchain adoptions.

Consultants and academics worry about the technological maturity of blockchain.

Competitive edge of the industry is highly influenced by economic factors related to financial and time-related aspects.

Blockchain Takes a Huge Shift in Infrastructure to Implement

Blockchain performs its best with more participants because there is more information. Without participants, the use case of blockchain no longer becomes applicable. Therefore, a decent size number of entities must agree on implementing blockchain which is harder than it sounds. Blockchain requires a huge shift in infrastructure. Instead of storing information on their own subscription platform, the information will instead be widely available to anyone in the network which may be intimidating. Not only that, but the technology is new, and companies are hesitant on uplifting their entire structure. The pilot program by The Port of Rotterdam and Busan has shown that blockchain does perform up to expectation, but only provides a single example of the tangible benefits of adoption. A few ports have started pilot testing since, but until we see more entities willing to integrate this technology, it will be a long time till we see any major shifts in supply chain management.

Blockchain is the Future of Logistics

As supply chains become increasingly complex to meet the needs of consumers, the benefits of blockchain are far too good to not be considered as a solution. Not only does it provide relief to cumbersome problems in logistics, but transparency is becoming an important factor to consumers. Ethical sourcing and detailed package tracking are just a few factors that consumers are starting to consider. Blockchain allows for trusted end-to-end product visibility, which will become more vital to companies and consumers alike.

Supply Chain Network Optimization – How to Do it Right

The time is right to re-align your Supply Chain Strategy, for many reasons including:

Logistics and fulfillment are the new storefronts and sales tools

The explosion of direct-to-consumer business forces all companies to have an omnichannel strategy.

The sourcing landscape is rapidly changing with more near-sourcing and risk minimizing.

Sustainability awareness is increasingly unavoidable - and transportation is a big piece.

The time is right to re-align your Supply Chain Strategy, for many reasons including:

Logistics and fulfillment are the new storefronts and sales tools

The explosion of direct-to-consumer business forces all companies to have an omnichannel strategy.

The sourcing landscape is rapidly changing with more near-sourcing and risk minimizing.

Sustainability awareness is increasingly unavoidable - and transportation is a big piece.

The traditional approach very often leads to more of an endless data crunch and, in best case, a mathematical answer that minimizes the theoretical logistics costs but does little to create an implementable supply chain strategy.

But you don’t do a network optimization to relive the linear programming classes from college and show your mathematical acumen. Well, some of us may. For the rest of you, here are some crucial hard-earned learning points from many network optimization projects:

1. Avoid Spending Time and Money Feeding the Monster with Data

Nobody has perfect data. A proper strategy for cleaning and curate the data will be one key to the success of the project.

The important thing is to know what data really matters and how to curate the imperfections into a usable dataset. The most critical data for the outcome is the shipment data and it is often the hardest data to get. If you don’t have access to this data internally, the carriers do have it. They are not always keen on sharing it, but they are still the best source. The order data is usually readily available and can be used to recreate shipments though the dim/weight can complicate things. This is an area where data-enrichment from firms specializing on this can work and also item profiling to reduce the complexity to where it matters.

Most advanced models require much more data to run, but the impact of other data is less critical and can in many cases be handled with benchmarks to get a starting point and sensitivity analysis where you rerun the model with the critical datapoint varied until you find the breaking point where the recommendation changes. It is much easier to make a call when you see where it really matters and have clear choices.

2. The model will not give you a strategy. It will only tell you which alternative is mathematically the best.

Before you run the model; use the data that has been collected to profile your supply chain. This will enable you to evaluate relevant solutions.

Customer profiles and requirements: Delivering to the big retailers demands a different solution than direct to consumer deliveries. Two separate networks?

Inventory profile: Certain products may have demand patterns very tilted geographically or being critical from a supply perspective. Slow-movers vs best sellers. Examples of facts that would determine the eligible alternative network structures to optimize such as Central DC, Regional DCs, Satellites, Forward Stocking Locations, etc.

Order profile, supply profile, product profile are other examples of facts that are important to analyze pre-modelling.

3. Sensitivity Analysis

Instead of trying to create the perfect dataset. Use the model to find out with what value on critical but uncertain data that the recommendation changes. This saves a lot of time and makes the decisions relevant.

4. Use the Right Software Tool for your Challenge

The most advanced optimization tools are expensive and require a lot of effort to configure. You’ve spent a lot of time and money before you are ready to run the model. This is totally worth the investment if your supply chain is very complex and you intend to, once configured, use the model frequently. Those software tools are sophisticated and awesome with all their possible add-ons.

Most companies have a more straightforward supply chain or can optimize the network in North America, or Europe, Asia, etc. separately and then piece them together. If this is the case, the most complex tools are complicating things without the added value. Spend the time and money you save on an adequate optimizing tool to focus on strategy development instead.