THE SUPPLY CHAIN BLOG

Ensuring a Successful Supply Chain Network Optimization Study

We previously wrote about some of the reasons and incentives for why a company would want to execute a supply chain network optimization study. Now, we would like to discuss some of the key contributing factors to consider when completing the supply chain network optimization study that will ensure both realistic and usable results.

We previously wrote about some of the reasons and incentives for why a company would want to execute a supply chain network optimization study. Now, we would like to discuss some of the key contributing factors to consider when completing the supply chain network optimization study that will ensure both realistic and usable results.

Modeling Tools

A supply chain network optimization study cannot be completed without using a supply chain modeling software tool. Modeling tools will be able to handle all the necessary data and backend calculations so that the user can focus on having the right inputs and interpreting the outputs. There are many different tools out there that will get the job done and each one has different pros and cons. Some of the main ones today include Supply Chain Guru, Blue Yonder and AIMMS, as well as our internal proprietary tool, ASSIGN.

Data

We talked about the multitude of data analysis that will be delivered during a supply chain network optimization study, but data will also be the major input that drives the model and strategy development. That being said, it is important to spend a large amount of the time up front focusing on the data. Collecting the right data and making sure the data is of reliable quality will determine how complex and detailed the study can get. The most important data to look at includes transportation/shipment data, sales order history data and inventory data. Getting all the supply chain cost elements (in particular, warehousing costs) will also be important for establishing the baseline costs. Because the data being used will be very granular, validating the data against financial reports is another extremely important step to ensure the data driving the project is correct and the project’s results, are therefore, realistic.

Business Rules & Constraints

While data is the most important factor during a supply chain network optimization study, the business rules and constraints should not be overlooked. This will be what restricts the model and ensures that the results are optimized to support the goals of the business. Business rules and constraints refer to parameters like a min or max inventory on hand and order fulfillment time (e.g. customers receive goods within 4 days) and should be discussed in the beginning of the project and updated as necessary. With the right software tool, these can be put right into the model.

Forecasting and Planning Factors

When reviewing the results of the supply chain network optimization study, it is important that they not only will work for the business as things are today but also will support the business over the next 5 years and beyond. That is why it is important to consider the demand forecast (as detailed or generic as it may be) and any planning factors. Planning factors are things that won’t be seen in the data, but should be considered, and can be anything from the opening/closing facility to tariff increases to needing a distribution center to be within a certain distance of a specific location. Ensuring that the forecast is properly understood, and all the planning factors are laid out early in the project, will be vital to feasibility of the results at the end of the project.

Considerations When Designing a Warehouse

Whether you are opening a new warehouse or distribution center, adding a product line, exploring automation, or just running out of space, there are many different considerations when optimizing a warehouse layout and associated processes. We wanted to share some insight regarding the Establish methodology for warehouse design projects, specifically the inputs we like to gather before any concepts are drawn or recommendations made.

Whether you are opening a new warehouse or distribution center, adding a product line, exploring automation, or just running out of space, there are many different considerations when optimizing a warehouse layout and associated processes. We wanted to share some insight regarding the Establish methodology for warehouse design projects, specifically the inputs we like to gather before any concepts are drawn or recommendations made.

First Steps – High Level Planning

The beginning of a warehouse design project should include a few conversations – those that define the scope of the project, success metrics, key stakeholders, and any headaches or concerns that should be solved by the new layout. It is important to lay everything out on the table, because the ‘optimal’ layout is not always the best suited to the operation and employees involved. Before beginning the project, it is paramount to understand company values, value propositions, goals, sales channels, customers, seasonality, and forecast. Additionally, involving all affected employees or group representatives and establishing rapport keeps everyone’s interests aligned.

Process & Material Flows

Following a high-level understanding of the business, the warehouse processes are of highest priority in determining warehouse layout. There is no better way to learn about process than physically being on the warehouse floor, walking through each decision point step-by-step. Shadowing, documenting, and talking with operators will be your greatest resources – no one knows the process better than those working it day-in and day-out. The time with operators develops buy-in for the future layout, ensuring that everyone’s needs and challenges are considered. While shadowing, it is important to remember to follow the entire lifecycle of a product through the warehouse, from the time it enters the premises through delivery into the customer’s hands. We’ve found that having a thorough understanding for the operation leads to better data analysis later in the project.

Data Analysis on Volumes

In addition to the qualitative observation of process, warehouse design should include a healthy amount of quantitative data analysis to determine product volumes and order profile as these are what dictate labor and spatial requirements. Order profile is the single most important piece of data for warehouse design, it is the driver for process and storage. Understanding how product is ordered, be it pallets/cases/eaches, will define what picking strategies you can deploy (think pick by order, batch, cluster, wave, or zone picking). Having a grasp on peak volumes, not just averages, assures the operation can withstand those high-volume days. Order profile, picking strategy, and volumes help determine inventory space necessary and labor hours involved.

Bringing it Together

The combination of process knowledge and data analysis as inputs for the design will allow for a better chance to land on a solution that is both optimal and meets the needs of the business. Once we’ve developed planning factors and worked through this qualitative and quantitative approach to the inputs, we can begin to iterate through concepts. Think of the observations and analysis we’ve done before as puzzle pieces – each piece (i.e. the amount of racking for a product, staging space, or machinery) is a defined amount of space. From here, we fit all those pieces together, draw material flows to follow the life cycle of the product, and visualize. After that, it’s all iteration.

What are the Benefits When Completing a Supply Chain Network Study?

It does not matter if a company is business-to-consumer (B2C), business-to-business (B2B) or direct-to-consumer (DTC), if the company distributes goods, then the supply chain will play a vital role. That being said, it is important for companies to be active when reviewing their supply chain network to ensure that it is set up optimally to support the business. We find that supply chain costs usually account for over 6-10% of sales, which can add up to a lot of money for large companies. Likewise, it is just as important for smaller companies to prioritize their supply chain strategy, as they may quickly and consistently outgrow or shift their current supply chain networks.

It does not matter if a company is business-to-consumer (B2C), business-to-business (B2B) or direct-to-consumer (DTC), if the company distributes goods, then the supply chain will play a vital role. That being said, it is important for companies to be active when reviewing their supply chain network to ensure that it is set up optimally to support the business. We find that supply chain costs usually account for over 6-10% of sales, which can add up to a lot of money for large companies. Likewise, it is just as important for smaller companies to prioritize their supply chain strategy, as they may quickly and consistently outgrow or shift their current supply chain networks.

One of the best ways to review the current supply chain strategy and determine how it can be improved is by doing a supply chain network study (aka supply chain network design or supply chain network optimization), which consists of loading data into a supply chain modeling software to test out different scenarios against the current supply chain (baseline). There are a lot of benefits that can come from doing a supply chain network study and some are more obvious than others.

Data Analysis

Every supply chain network study starts with lots and lots of data. This data will be used in more than one way throughout the study. In addition to being what drives the model, there are loads of analysis that take place in the beginning portion to understand the business and see what sort of inventory and distribution strategies make sense. We find that most of the time our clients do not have the time or resources to complete detailed analysis on a consistent basis so usually a lot is learned before the network modelling even starts. This can pinpoint areas for the company to focus on outside of the supply chain network study and lead to the development of different supply chain strategies that were not thought of previously.

The Baseline

Creating a digital replica of the current supply chain network costs, known as the baseline, is another major portion of the supply chain network study. This will show the current nodes or locations involved in the supply chain and all of the supply chain related costs. This information will give a good indication of where the highest costs are and be the starting point for comparing alternatives. In addition to costs, the baseline will also give a look into the current service levels being achieved, a visual representation of ship patterns, and a look at volumes vs capacity to see what areas of the supply chain might be strained.

Center of Gravity

The center of gravity analysis uses demand data to determine the optimal location or locations for a specified number of DCs. It can be a quick and simple way to answer questions about location and number of locations and will help make decisions when determining what scenarios to run later in the study.

Scenario Comparison

The ability to compare different scenarios without making any physical changes is probably the most significant deliverable when doing a supply chain network study. Once the baseline is created, different distribution strategies and node locations can be modeled to see their impact on costs, service levels, ship patterns and volumes against the baseline. Most scenarios tested should be based on the data analysis that was done, but there is a lot of freedom. If you have ever wondered what would happen if you moved your operation across the country or sourced products from the one country instead of another, a network study can tell you what that would look like.

The Final Deliverables

Supply chain network studies generate a lot of deliverables. The results/answers will be based on what is important to the business. Some companies might prioritize 2-day shipping where others want to minimize costs and improve bottom line. Regardless of the main goal, the supply chain network study offers insight into a variety of considerations, such as sourcing, distribution and inventory strategy including number of distribution centers, distribution center location(s), ship patterns and what to store where. This information can help make key strategic decisions for the supply chain and the business as a whole.

Self-Driving Trucks - A New Age for Ground Shipping

Self-driving commercial trucks have been a hot topic for the past few years as several companies have joined this sector in an innovative movement to become the first to establish a fully disengaged trucking network. A fully disengaged trucking network would negate the need for the driver to interact with the vehicle, but still be available in case of emergencies. The development of this technology could lead to possible reduced labor costs and reduced transit times.

Self-driving commercial trucks have been a hot topic for the past few years as several companies have joined this sector in an innovative movement to become the first to establish a fully disengaged trucking network. A fully disengaged trucking network would negate the need for the driver to interact with the vehicle, but still be available in case of emergencies. The development of this technology could lead to possible reduced labor costs and reduced transit times.

What are self-driving trucks?

Self-driving trucks or “robo-trucks” focuses on autonomous technology that does not require a human driver. The idea is like that of self-driving cars, but with constraints and considerations such as load weight and distance traveled. Though self-driving trucks and electric vehicles are commonly associated with one another, electric vehicles primarily focus on the renewable and sustainable energy mainly for the retail use. Though they are different, the two sectors have been developing almost in parallel.

Who are the major players and Where are we now?

A few major players in this area are Waymo, formally known as the Google self-driving car project, TuSimple, Gatik, and Embark. These companies have already began mapping out their trucking network and chances are you may have already seen them on the road. Waymo and GM Cruise have completed 11,017 and 5,205 miles respectively of disengaged travel. TuSimple’s longest mapped route is 1,000 miles between Phoenix and Dallas. In fact, they have begun a four-year plan to go nationwide by 2021, traveling cross-country from Los Angeles to Jacksonville. They also intend to completely remove a person behind the wheel is 2021.

Various partnerships have been established such as Waymo with UPS and AutoNation and the start-up Gatik will begin delivering for Walmart in 2021. Embark, in collaboration with Amazon, has begun transportation of Frigidaire refrigerators from El Paso to Palms Spring. Though we are far from implementing self-driving trucks on a nationwide scale, these partnerships represent the commitment to this sector.

Impacts and Looking Ahead

As self-driving trucks start to become more common, there are areas in supply-chain and logistics that will be affected and need to be considered.

1. Quality and Safety of goods

Who becomes responsible for the quality and safety of the goods? It could be placed upon the company to reformat their packaging strategy to be more secure or the freight forwarder to ensure that the transportation of goods is secured. The safety of the goods is a priority to consider which may impact the relationships and responsibilities between these entities.

2. Adaption of transportation management systems

As self-driving trucks become integrated in the industry, managers need to consider what new types of data need to be collected to ensure that the transportation of goods is optimal. When trucks arrive at their destination, how is communication going to be accurately logged and confirmed that the goods were not only obtained, but that the trucks are also meeting regulations? Transportation management systems will need to adapt to this new mode of transit and be able to consider new elements that may arise.

3. The career of truck drivers

A major discussion on the impact of self-driving is the career of truck drivers. With the male workforce dominating the trucking profession at over 90%, people wonder if it would make the career obsolete. Are these drivers expected to learn the new technology to keep up with the innovation? TuSimple has tried to proactively combat this possible problem by offering a program at Pima Community College to help truck drivers adapt to the new technology. On the other hand, self-driving trucks can be implemented as a driver assist technology (rather than driver replace) on long routes to reduce breaks required and travel time. For example, the 11-hour driving limit could be prolonged if the driver can rest while on route, reducing fatigue.

Circular Supply Chains - A Step Towards Sustainability

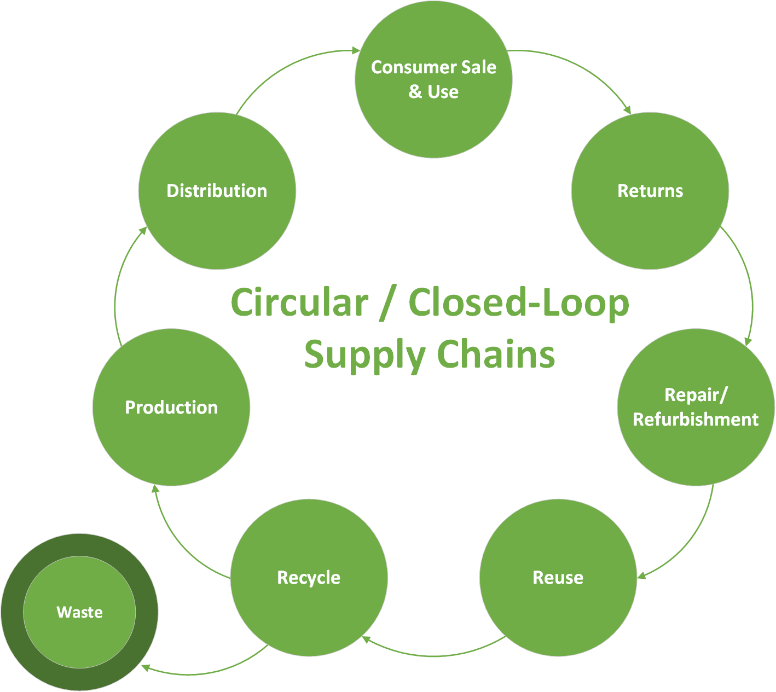

Building upon last week, we are taking a deeper dive into the sustainability movement of circular (a.k.a closed-loop) supply chain practices. The world is moving on from the 'cradle-to-grave' supply chain practice of product manufactured, distributed, used and thrown out. Circular supply chains can be described as the combination of standard logistics and reverse logistics in order to create a circular logistical lifecycle. Products in the reverse logistics flow can be redistributed, repaired for continued use, remanufactured in case of defects, or recycled into parts and materials that have been carefully selected for this purpose.

Building upon last week, we are taking a deeper dive into the sustainability movement of circular (a.k.a closed-loop) supply chain practices. The world is moving on from the 'cradle-to-grave' supply chain practice of product manufactured, distributed, used and thrown out. Circular supply chains can be described as the combination of standard logistics and reverse logistics in order to create a circular logistical lifecycle. Products in the reverse logistics flow can be redistributed, repaired for continued use, remanufactured in case of defects, or recycled into parts and materials that have been carefully selected for this purpose. This diagram maps out what a circular supply chain could look like:

Completely closing the loop is an incredibly ambitious goal - zero-waste is no simple task. Significant motivations for circular supply chain economics include the following:

1. Recovered product reduces waste, minimizes direct costs and offers secondary value. Waste reduction is clear - less product heads to landfills when its return is incentivized. Direct costs can be avoided by reusing product as input to production. Finally, secondary value is achieved through sale of recovered outputs on secondary markets.

2. Improved brand-image and customer loyalty. Circular supply chains, and sustainability in general, are mainstream - an outwardly sustainable company earns positive publicity. Returns, repairs, and refurbishment allow for consistent warranty practices that earn customer loyalty and future sales.

3. Product improvement through more data. With more products returning to producer's hands, the entire product lifecycle can be mapped out and defects, usage, and feedback can be utilized to improve product design.

Case Study: IKEA Furniture

In the last 10 years, patience as a consumer has become thin. 'Fast' trends are in - be it 2-day shipping, fast fashion, and even fast furniture. Similar to the way Zara and H&M turned the apparel industry into a race for who could adapt quickly and provide cheap trendy styles, the furniture industry has shifted towards products with a life cycle of 1-2 years. They are low-quality, easy to assemble, and can be left behind when moving residences. IKEA was at the forefront of this trend, and has made significant investment to shift their narrative and lead sustainability initiatives in the furniture industry.

IKEA has explored a multitude of strategies to push towards their goal to be 100% circular using only renewable and recycled materials. Their solutions range from product leasing to secondary markets to using circular materials that can be remanufactured into new products. While the company recognizes its shortcomings - and is realistically very far from their goal - these are big steps for an industry leader and Fortune 100 company to make. Read more about it here.

Why you Should Prioritize Reverse Logistics and Returns Management

This year, returns set an all new single-day high and certain companies are so overwhelmed that they are refunding consumers and telling them to keep the items rather than shipping them back. Returns have become a large pain point for many companies and can add a lot of extra costs when not handled correctly. A thorough understanding for reverse logistics and returns management can allow companies to minimize the added costs and recoup some value while earning increases in customer loyalty.

This year, returns set an all new single-day high and certain companies are so overwhelmed that they are refunding consumers and telling them to keep the items rather than shipping them back. Returns have become a large pain point for many companies and can add a lot of extra costs when not handled correctly. A thorough understanding for reverse logistics and returns management can allow companies to minimize the added costs and recoup some value while earning increases in customer loyalty.

Returns can happen in any industry for many different reasons. Whether the reason for return is the consumer’s fault (e.g. they ordered the wrong size), a carrier’s fault (e.g. product got damaged during transit) or the distributor’s fault (e.g. shipped an expired product) every company should prepare themselves to handle reverse logistics and returns.

The What: Standardized Process with Automated Workflows

All efficient returns management strategies rely on understanding returns data so that standardized processes can be built, and workflows can be automated. This will prepare an operation to handle all the different returns and minimize the decision making happening in real-time. Defining necessary functionality and selecting appropriate support systems is good practice. A pre-screen with the consumer to allocate the return into the correct workflow allows the logistics team to predict and plan for inbound goods. Workflows can vary company to company, but a quality check is consistent. Assessing goods and distribution into pre-determined workflows leads to quick turnaround time and fastest recouping of investment.

The Why: Financial Incentive AND Customer Loyalty

Financial incentive is clear – the opportunity to resell the goods and recoup value, whether on the primary market in full or a secondary market for fractions. What is less recognized, is the influence on customer management. Customer expectations are high for returns – quick and easy response with free shipping. Managing that relationship can go a long way. Remember that returns contribute to the bigger picture: customer loyalty and repeat sales.

The How: Valuation

With every product, being able to appraise a return is absolutely necessary. Understanding why the return is being made, any repair/refurbishment costs necessary and the future-value of the product reselling (if at all) on the primary or secondary market is key. Having a system in place to do so is extremely important. It has even led to some companies leaving the product with consumer free of charge.

Goods valuation does not paint the entire picture. A considerable piece of the puzzle is customer loyalty and retention. Determining value here is specific to each company, and something not to be ignored.

Looking Ahead

A trend significant of late is that of sustainability. Government regulations have taken interest in the proper disposal of goods and incentivized reuse and recycling. Secondary markets have flourished in recent years, leading to the development of closed-loop supply chains – those with 0 waste. We predict that 2021 continues to bring a focus to ESG initiatives, and that those not invested there will be left behind.

Warehouse Automation: Where to Start?

In the days of the pandemic (and even pre-pandemic), the trends and challenges facing the warehouse industry are clear: difficulty finding labor. As such, exploring automation for warehouses has never made more sense. However, it is a daunting task to understand and explore how to start. Below, we explore basic options to explore warehouse automation.

In the days of the pandemic (and even pre-pandemic), the trends and challenges facing the warehouse industry are clear: difficulty finding labor. As such, exploring automation for warehouses has never made more sense. However, it is a daunting task to understand and explore how to start. Below, we explore basic options to explore warehouse automation.

Automated Repeated Material Movements

Automating activities that only people can do is difficult to achieve currently; however, there are repetitive movements such as walking or transporting material that can be automated, typically at a good ROI.

For carts, something like CartConnect works well. Also, conveyance is always a good option. For repeatable pallet load movements, AGV forklifts are good at moving loads from one end of an operation to another.

Automated Storage and Retrieval

The second option is arguably the most automated – automated storage and retrieval (ASRS). There are many systems under this umbrella, but the concept remains the same for all: the ASRS will take product the operation has received, automatically store them, then pick/deliver them to an operator as needed.

Systems range from a mini-load system to a full pallet ASRS to the new solutions on the market for smaller product like the AutoStore. Also included are dense/fast-pick solutions such as vertical lift modules (VLMs) and horizontal and vertical carousels.

Whichever system is selected, the benefits are the same: more efficient storage space and reduced warehouse labor in putaway and picking, 2 of the most time-consuming processes in distribution operations.

Transaction Automation

Though perhaps not the first thing to come to one’s mind when thinking of warehouse automation, transaction automation is arguably the most important. This is a very broad term but stands for eliminating manual operator interactions to log transactions. The default way for an operator to log inventory movements, receipts, etc. is to manually type it in to the ERP or WMS. The ways to automate this are varied, from RF guns/scanning to RFID to voice picking to put-to-light/push buttons. Regardless of the method, automating transactions improves

5 Supply Chain Trends for 2021

This past year has created many new challenges for everyone, causing consumers and companies to adapt. We expect some of the supply chain changes to be temporary but that many of them will have a lasting impact on the supply chain industry going forward. Below, we discuss some of the trends that we expect to see in 2021.

This past year has created many new challenges for everyone, causing consumers and companies to adapt. We expect some of the supply chain changes to be temporary but that many of them will have a lasting impact on the supply chain industry going forward. Below, we discuss some of the trends that we expect to see in 2021.

Fulfillment and Logistics as a Competitive Tool

Every year we continue to see consumer behavior change, and in no year has that change happened as rapidly as in 2020. People want to get quality goods for a reasonable price and quickly. Unorganized supply chains will become increasingly exposed as companies will have to choose between bad service levels or unsustainable costs to meet customer demand. The most obvious example of this trend is Amazon's move to achieve next-day or same-day shipping. As stated above, consumer expectations for service continue to rise. This means businesses that have systems in place to forecast well, stock optimal levels of inventory and fulfill efficiently have a significant advantage over those that do not.

Focusing on E-Commerce, Service Levels and Omnichannel Development

The shift from brick and mortar retail to e-commerce has been growing every year, and COVID-19 only expedited that growth even more. It's no surprise that consumer’s extreme shift to e-commerce seen in 2020 will have a lasting effect on the way people do business moving forward. In addition to the e-commerce shift, service levels are also becoming a higher focus as consumers are going to choose the quickest and most reliable option. To keep up with these shifts, companies are going to have to continue to focus on developing their omnichannel strategy. This means using support systems to create an interconnected network of stores, warehouses and 3PLs, providing the flexibility to fulfill both large wholesale purchases and small e-commerce orders. Companies can then leverage this interconnectivity within the network to optimize fulfillment strategy on an order level basis.

Shifting E-Commerce to a 3PL

Another industry trend we expect to see is a significant shift for e-commerce distribution towards third-party logistics companies (3PLs). The e-commerce industry, in comparison to brick and mortar stores, presents a complexity that is hard to tackle for smaller companies. 3PLs provide an option that will allow companies to set up much quicker than if they opened their own warehouse and allow them to avoid significant fixed costs, have access to an already established network and get specialized processes based on their needs.

Making Procurement a Focus

COVID-19 complications and global trade friction with China mixed with consumer’s increasing expectations for better service have signaled to the supply chain world that now may be the time to focus on procurement. By moving suppliers closer to home (near-shoring) and prioritizing the procurement process to make lead time and flexibility priorities, companies can improve their fulfillment times and overall supply chain. Developing a regional supply chain offers the better potential for mutually beneficial relationships and improves both time and proximity to market. This confidence in relationship management and product could challenge the prior approach of low-cost country sourcing.

Freight Normalization – A New Baselinne

COVID-19 has caused overwhelming increases to volume causing capacities to be tested and costs and rejection rates to skyrocket. As the freight companies profit on these higher rates, it can be expected that they will reinvest into capital expenditures, such as more trucks, increasing capacity to meet market demand and normalizing from the economic shifts of 2020.

We wish everyone a safe and healthy 2021.